不知道大家在考场上有没有碰到

什么难题、怪题?

让你措手不及的

今日学姐依旧帮大家征集了

学员考生反应的CFA知识高频考点

希望看到的人CFA都能

过过过过过过过过过

▼

CFA高频考点

1 收入法核算GD

关联科目及章节:经济-R10-总产出、价格水平和经济增长

考点介绍:

GDP可以说是整个宏观经济学的基石,其定义和核算方法为后续许多宏观经济的课题埋下伏笔,除了最重要的支出法以外,收入法和产出法也要求考生掌握。

知识复习:

收入法的核算其实也有两种,一个是根据来源,一个是根据去向(也就是C+S+T),员工的工资加奖金、企业的税前利润、个体户的收入都属于劳动型收入,而进行投资获取的利息、房租都属于资本性收入,这个和收入去向法中的储蓄并没有严格的一一对应关系;

金融投资其实就是储蓄中相当大的一部分,自然是计入GDP的,只不过不是直接核算,而是在“金额”这个层面和支出法、产出法的结果一致而已。

相关习题:

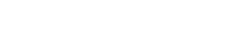

Mike Brown,CFA,collected the following data of various accounts at the end of the year 2015:

Using the income approach,the gross domestic product(GDP)is closest to:

A.37

B.47

C.54

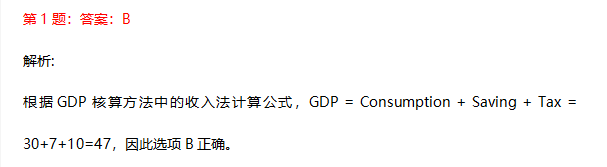

查看答案+详细解析

2 直接法计算CFO

关联科目及章节:财报-R19-现金流量表

考点介绍:直接法作为现金流尤其是经营现金流的计算是计算方面的重点,每年都会遇到。考试主要以计算直接法里某一项的现金流入或者流出值,或者某个量变动会如何影响经营现金流。

知识复习:

直接法计算CFO主要为“一收四支”。具体为:

+Cash Received from Customers;

-Cash Paid to Suppliers;

-Cash Paid to Employees;

-Cash Paid for Interest;

-Cash Paid for Income Taxes;

有的时候考试也会出具其他的经营活动现金支出相关的项目,则Cash Paid for other Operating activities也需要考虑在内。

相关习题:

An analyst gathered the following information from a company’s 2013 financial statement(in$millions):

Based only on the infomation ablove,the company’s 2013 statement of cash flows in the direct format would include amounts(in$millions)for cash received from customers and cash paid to suppliers,respectively,that are closest to:

A.249.7,169.7

B.259.5,174.5

C.259.5,182.1

查看答案+详细解析

3 区分交易所市场与场外市场

关联科目及章节:衍生-R45-衍生品市场和工具

考点介绍:

衍生品科目的第一个章节的知识虽然在后续二三级学习中不再直接出现,但是打下了对于衍生品的基础认识,对于后续的定价和估值的学习有很大的基石作用,尤其是交易所市场与场外市场的区分,值得仔细把握。

知识复习:

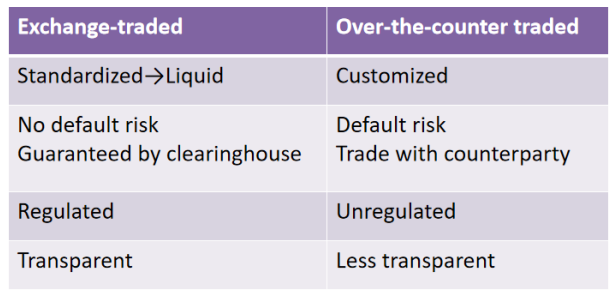

交易所市场与场外市场有许多差异存在,如图所示:

由于08年金融危机之后,世界各国普遍加强了对于场外市场的监管,因此,四个差异中,监管和信息的透明性方面的差异性已经越来越不明显,场外市场的违约问题也逐步在得以解决,但是合约的标准化或个性化这一差异点基本没有改变,也成为两类市场目前最大的差异点所在。

相关习题:

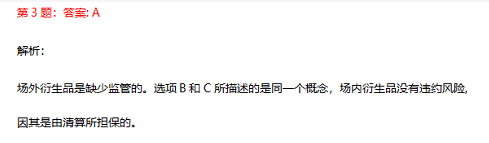

The over-the-counter derivatives most likely include the characteristic of:

A.being less regulated.

B.being guaranteed by a clearing house.

C.default-free.

查看答案+详细解析

4 适合性

关联科目及章节:道德-R58-CFA职业行为准则

考点介绍:

客户利益至上是CFA协会道德准则一个比较明确的倾向,其中,向客户推荐适合其的理财产品又是非常重要的一点,因此,本细则历来是道德科目的高频考点,考生务必引起重视。

知识复习:

适合性属于第三大准则的第三条细则,要点在于当会员和候选人向客户提供投资咨询或管理服务时,必须充分调研客户的具体情况,定期评估更新相关信息,确保给出的投资推荐或采取的投资行动符合客户的特点。

相关习题:

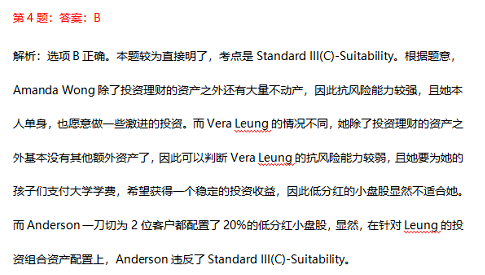

Clark Anderson,CFA,is an investment adviser of Golden Finance.Anderson has two clients:Amanda Wong,45 years old,and Vera Leung,48 years old.These two clients earn the same level of wage income.Amanda Wong,however,has a large number of real estate assets,whereas Vere Leung has few assets outside her investment portfolio.Wong is single and willing to invest a portion of her assets very aggressively;Leung wants to achieve a steady rate of return with low volatility so she can pay for her children’s current college tuition fees.Anderson recommends investing 20%of both clients’portfolios in the stock of very low yielding small-cap companies.According to the CFA Institute Code and Standards,Anderson is least likely in violation regarding his investment recommendations for:

A.both clients’portfolios.

B.only Wong’s portfolio.

C.only Leung’s portfolio.

查看答案+详细解析